Understanding Lifetime Customer Value opens the door to unlocking the secrets of customer loyalty and profitability in a fast-paced market. Dive into the world of LCV with us as we explore the ins and outs of this crucial business concept.

What is Lifetime Customer Value (LCV)?

Lifetime Customer Value (LCV) is a metric that represents the total revenue a business can expect from a single customer over the entire duration of their relationship. It is a crucial concept for businesses to understand as it helps them determine how much they should invest in acquiring and retaining customers.

Calculating Lifetime Customer Value

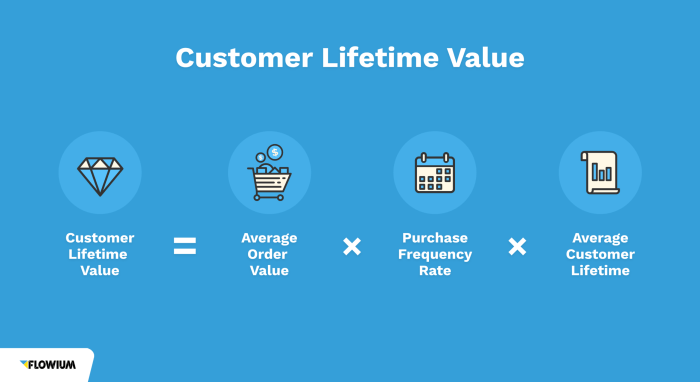

To calculate Lifetime Customer Value, you can use the following formula:

LTV = (Average Value of a Sale) x (Number of Repeat Transactions) x (Average Retention Time)

- First, determine the average value of a sale from a customer.

- Next, calculate the number of repeat transactions a customer is likely to make over their relationship with your business.

- Then, estimate the average retention time of a customer before they churn or stop doing business with you.

- Multiply these three values together to get the Lifetime Customer Value.

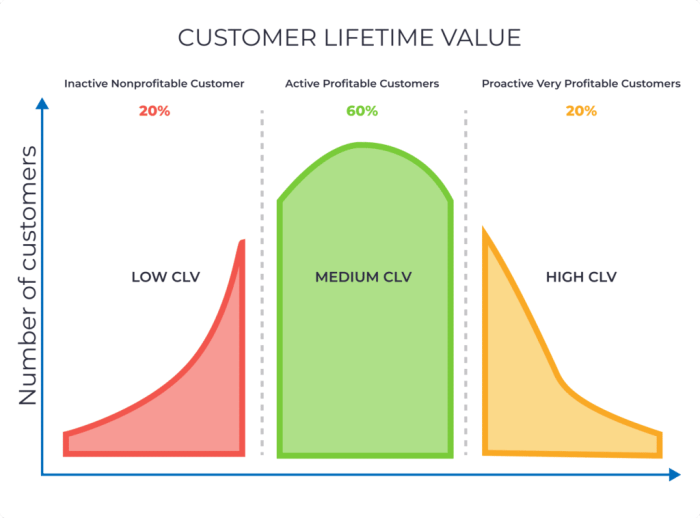

Importance of Understanding LCV for Businesses, Understanding Lifetime Customer Value

- Helps businesses allocate resources efficiently by focusing on high-value customers.

- Guides marketing strategies to target the right customer segments for maximum ROI.

- Aids in setting pricing strategies based on the long-term value customers bring to the business.

- Allows for better customer retention efforts to increase overall profitability.

Factors influencing Lifetime Customer Value

When it comes to Lifetime Customer Value (LCV), several key factors play a crucial role in determining the overall value that a customer brings to a business over their entire relationship. Understanding these factors and how they can be optimized is essential for businesses looking to increase their LCV.

Quality of Products/Services

The quality of products or services offered by a business is a significant factor influencing LCV. Customers are more likely to remain loyal and make repeat purchases if they are satisfied with the quality of what they are receiving. Businesses that prioritize maintaining high-quality standards are likely to see an increase in their LCV as a result.

Customer Service

Another important factor that influences LCV is the level of customer service provided by a business. Customers value excellent customer service and are more likely to continue doing business with a company that prioritizes their needs and concerns. By investing in top-notch customer service, businesses can enhance customer loyalty and increase their LCV.

Brand Reputation

The reputation of a brand also plays a significant role in determining LCV. Customers are more likely to trust and remain loyal to brands with a positive reputation for delivering on their promises and providing exceptional experiences. Businesses that focus on building and maintaining a strong brand reputation are likely to see a positive impact on their LCV.

Customer Engagement

Engaging with customers on a regular basis can help businesses increase their LCV. By building strong relationships with customers through personalized interactions, businesses can create a sense of loyalty and trust that leads to repeat purchases and long-term relationships. Businesses that prioritize customer engagement strategies are likely to see a boost in their LCV.

Industry-Specific Factors

Different industries may prioritize these factors differently based on their unique characteristics and customer expectations. For example, a luxury brand may place more emphasis on product quality and brand reputation, while a fast-food chain may focus more on customer service and convenience. Understanding industry-specific factors is essential for businesses to tailor their approach and optimize LCV effectively.

Calculating Lifetime Customer Value

When it comes to calculating Lifetime Customer Value (LCV), there are various methods that can be used to determine the long-term value a customer brings to a business. Having an accurate understanding of LCV is crucial for making informed decisions regarding marketing strategies, customer retention efforts, and overall business growth.

Different Methods for Calculating LCV

- The Historic CLV Formula: This method involves looking at past data on customer purchases, average order value, purchase frequency, and customer lifespan to calculate LCV.

- The Predictive CLV Formula: This method uses data analytics and predictive modeling to forecast future customer behavior and estimate their lifetime value.

- The Cohort Analysis Method: This method groups customers based on a shared characteristic (e.g., acquisition date) and analyzes their purchasing patterns over time to determine LCV.

Step-by-Step Guide on How to Calculate LCV

- Collect Relevant Data: Gather information on customer purchases, average order value, purchase frequency, and customer retention rates.

- Calculate Average Lifespan: Determine the average length of time a customer continues to purchase from your business.

- Compute Revenue per Customer: Multiply the average order value by the purchase frequency to get the revenue generated by each customer.

- Calculate LCV: Multiply the revenue per customer by the average lifespan to obtain the Lifetime Customer Value.

Importance of Accurate Data in LCV Calculations

Having accurate data is essential when calculating LCV as it directly impacts the reliability and validity of the results. Inaccurate or incomplete data can lead to faulty assumptions and inaccurate estimations of customer value, which can ultimately affect business decisions and strategies.

Strategies to enhance Lifetime Customer Value: Understanding Lifetime Customer Value

Enhancing Lifetime Customer Value (LCV) is crucial for the long-term success of a business. By implementing effective strategies, companies can increase customer loyalty, repeat business, and overall profitability.

Personalized Marketing Campaigns

One effective strategy to enhance LCV is through personalized marketing campaigns. By tailoring promotions and messages to individual customers based on their preferences, purchase history, and behavior, companies can increase customer engagement and loyalty.

Reward and Loyalty Programs

Implementing reward and loyalty programs can also boost LCV. Offering incentives such as discounts, exclusive offers, or freebies to loyal customers can encourage repeat purchases and increase customer retention.

Exceptional Customer Service

Providing exceptional customer service is another key strategy in enhancing LCV. By offering timely support, resolving issues promptly, and creating a positive customer experience, businesses can build long-lasting relationships with customers and increase their lifetime value.

Cross-selling and Up-selling

Utilizing cross-selling and up-selling techniques can also help increase LCV. By recommending complementary products or upgrades to customers based on their purchase history, companies can maximize the value of each customer transaction.

Real-world Example:

Amazon’s recommendation engine suggests products based on customers’ browsing and purchase history, effectively increasing LCV by encouraging additional purchases.

Role of Customer Experience

Customer experience plays a crucial role in boosting LCV. By focusing on delivering a seamless, personalized, and memorable experience at every touchpoint, businesses can enhance customer satisfaction, loyalty, and ultimately, their lifetime value.