How to calculate your net worth is the ultimate key to unlocking your financial status. Get ready to dive into the world of assets, liabilities, and financial freedom with this comprehensive guide.

Understanding the ins and outs of your net worth will set you up for financial success like never before.

Introduction to Net Worth Calculation

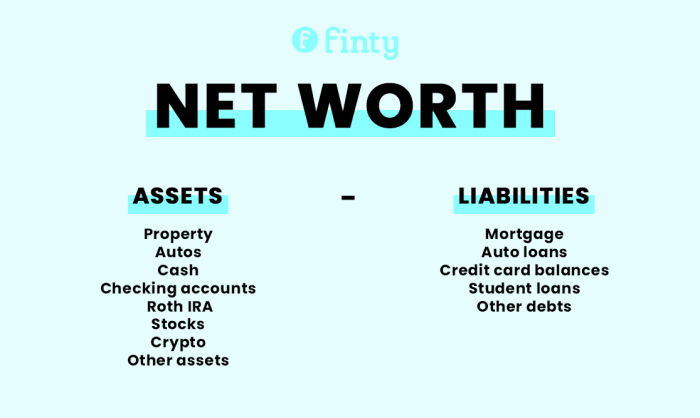

Net worth is a financial metric that represents the difference between a person’s assets and liabilities. It is a snapshot of an individual’s financial health at a specific point in time.

Calculating net worth is crucial for financial planning as it helps individuals understand their overall financial position. By knowing their net worth, people can track their progress towards financial goals, identify areas for improvement, and make informed decisions about saving, investing, and spending.

Assets and Liabilities Contributing to Net Worth

Assets are items of value that a person owns, such as cash, investments, real estate, vehicles, and personal belongings. Liabilities, on the other hand, are debts and financial obligations, including mortgages, car loans, credit card balances, and student loans. When calculating net worth, assets are subtracted from liabilities to determine the final figure.

Identifying Assets: How To Calculate Your Net Worth

When calculating your net worth, it’s crucial to identify all your assets, which are anything of value that you own. Here are some common types of assets individuals may have:

Real Estate

Real estate includes properties you own, such as your primary residence, vacation homes, rental properties, or land. To determine the value of real estate, you can use appraisal values, recent sales of similar properties in your area, or online real estate platforms.

Investments

Investments encompass stocks, bonds, mutual funds, retirement accounts, and any other financial assets. The value of investments can fluctuate, so it’s essential to use current market values when calculating your net worth.

Personal Belongings

Personal belongings consist of items like vehicles, jewelry, electronics, furniture, and collectibles. While these items may have sentimental value, it’s essential to assess their market value accurately. You can use online marketplaces or professional appraisers to determine their worth.

Difference between Liquid and Illiquid Assets

Liquid assets are easily convertible into cash without significant loss of value, such as savings accounts or stocks. On the other hand, illiquid assets cannot be quickly sold without potential loss, like real estate or certain investments. It’s important to consider the liquidity of your assets when evaluating your net worth.

Identifying Liabilities

When calculating your net worth, it’s essential to consider your liabilities, which are the debts and financial obligations you owe. Understanding your liabilities is crucial in determining your overall financial health and net worth.

Different Types of Liabilities

- Loans: These can be student loans, personal loans, or auto loans, where you borrowed money and are required to pay it back with interest.

- Mortgages: A mortgage is a loan taken out to purchase a home, with the property serving as collateral for the loan.

- Credit Card Debt: This includes any outstanding balances on credit cards, which typically have high-interest rates if not paid off in full each month.

Calculating Total Amount Owed for Each Liability

To calculate the total amount owed for each liability, you need to add up the outstanding balance on the loan, mortgage, or credit card. This amount represents the principal balance you still owe, not including any interest.

Impact of Liabilities on Net Worth Calculation

Liabilities have a direct impact on your net worth calculation by reducing the total value of your assets. When you subtract your total liabilities from your total assets, you get your net worth. The more debt you have, the lower your net worth will be.

Net Worth Calculation

Calculating your net worth is essential to understanding your financial health. It gives you a clear picture of your financial situation by subtracting your liabilities from your assets.

Step-by-Step Guide

- List all your assets: This includes cash, investments, real estate, vehicles, and any valuable possessions.

- Identify your liabilities: Make a list of all your debts such as mortgages, student loans, credit card balances, and other outstanding payments.

- Calculate your total assets by adding up all the values.

- Calculate your total liabilities by adding up all the amounts owed.

- Subtract your total liabilities from your total assets to determine your net worth.

Formula for Net Worth Calculation

The formula for calculating net worth is:

Net Worth = Total Assets – Total Liabilities

Tips for Organizing Assets and Liabilities

- Keep track of all your financial accounts and investments in one place for easy access.

- Regularly update your list of assets and liabilities to ensure accuracy in your calculations.

- Categorize your assets and liabilities to make the calculation process smoother.

- Consider using financial management software to streamline the process and provide detailed reports.

Importance of Tracking Net Worth

Tracking your net worth regularly is essential for financial management and planning. It provides a clear picture of your financial health and helps you make informed decisions about your money.

Benefits of Tracking Net Worth

- Identifying Financial Progress: Regularly updating your net worth allows you to see how your assets and liabilities are changing over time. This can help you track your financial progress and make adjustments to achieve your financial goals.

- Budgeting and Planning: By knowing your net worth, you can create better budgets and financial plans. Tracking your net worth helps you understand where your money is going and how you can improve your financial situation.

- Monitoring Investments: If you have investments, tracking your net worth can help you evaluate the performance of your investment portfolio and make necessary adjustments.

Tools for Tracking Net Worth

There are various tools and software available to help individuals track their net worth effectively. Some popular options include:

Wealth management apps like Mint, Personal Capital, or YNAB (You Need A Budget) can automatically sync your financial accounts and provide detailed insights into your net worth.

Changes in Net Worth Over Time, How to calculate your net worth

Your net worth can change over time due to various factors such as income, expenses, investments, and debt repayment. Monitoring these changes can reflect your financial progress and help you make informed decisions about your money.

Factors Influencing Net Worth

Various external factors can significantly impact an individual’s net worth calculation. These factors include lifestyle choices, investments, and debts, which play a crucial role in determining one’s overall financial health.

Lifestyle Choices

Lifestyle choices can have a direct impact on net worth as they determine how much money is spent on expenses and how much is saved or invested. For example, individuals who prioritize saving and investing tend to have a higher net worth compared to those who spend lavishly on unnecessary items.

Investments

Investments are another key factor that influences net worth. The type of investments made, their returns, and how well they are managed can either increase or decrease one’s net worth. Smart investment decisions can lead to significant growth in net worth over time.

Debts

Debts, such as loans and credit card balances, can negatively impact net worth by reducing the total assets an individual has. It’s essential to manage debts wisely and avoid accumulating high-interest debt to maintain a healthy net worth.

Strategies to Improve Net Worth

There are several strategies individuals can implement to enhance their net worth over time. These include creating a budget, reducing unnecessary expenses, increasing income through side hustles or investments, paying off debts, and consistently tracking net worth to monitor progress.